individual tax rate 2018 malaysia

By August 1941 American president Franklin Roosevelt and British prime minister Winston Churchill had drafted the Atlantic Charter to define goals for the post-war world. Introduced a goods and services tax in 1986 and then reduced the top income tax rate from 66 to 48 in 1988 and then 33 in 1989.

The Purpose And History Of Income Taxes St Louis Fed

Benefit From Success Essays Extras.

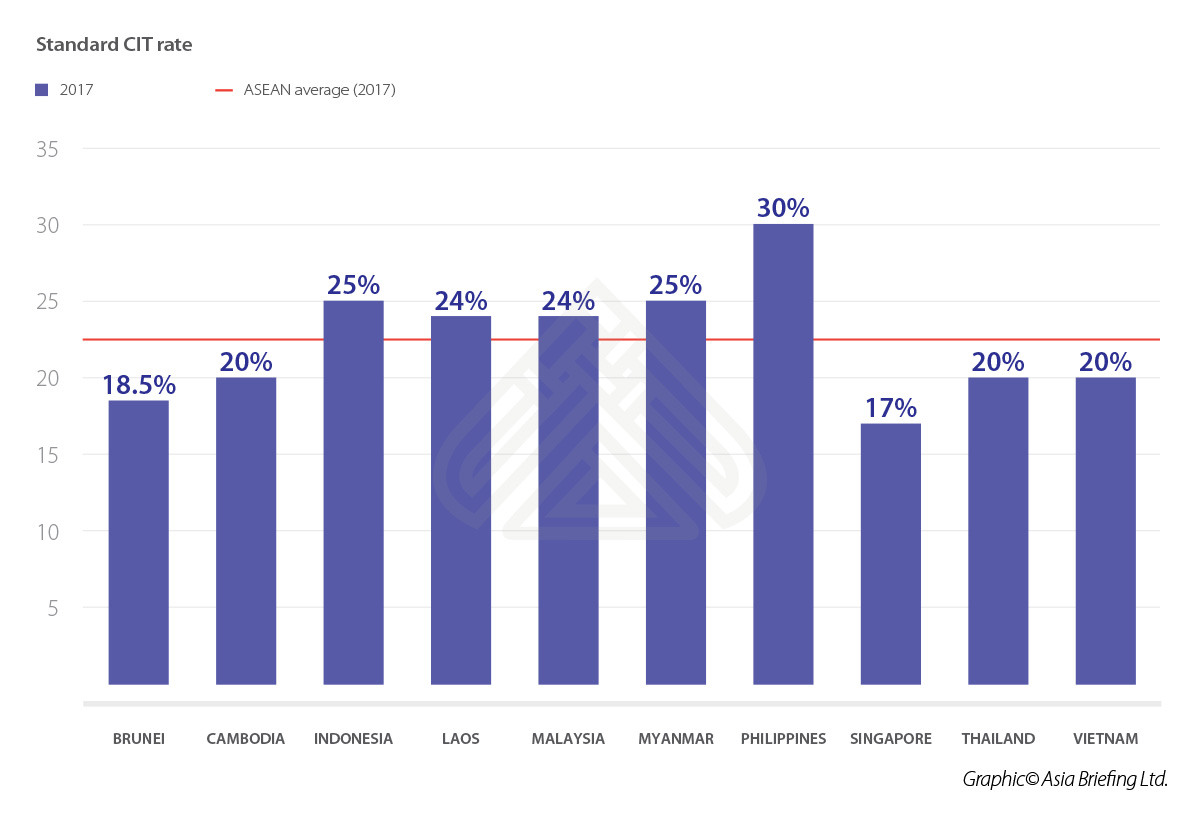

. SST Treatment in Designated Area and Special Area. Inflation rate in Italy 2015-2018 by macro-region. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP for 180 separate tax.

A TV licence is therefore effectively a hypothecated tax for. A tax haven is a jurisdiction with very low effective rates of taxation for foreign investors headline rates may be higher. Interest paid to a NR payee is subject to withholding tax at 15 or any other rate as prescribed under the Double.

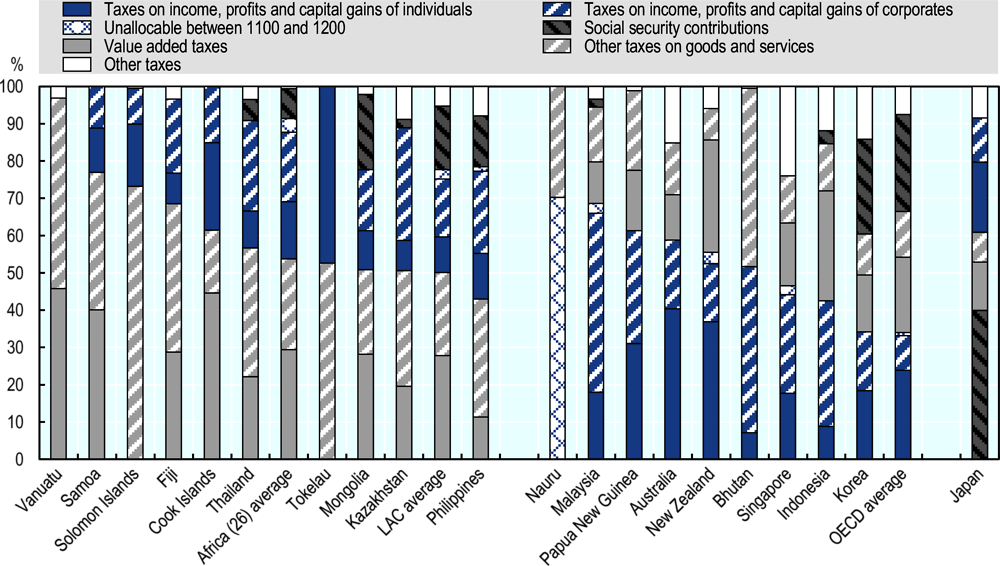

On the First 5000 Next 15000. We help you take charge with easy-to-use tools and clear choices. Tax revenues in Africa represent an increasing share of GDP during the last decade 2012 Figure 51.

Introduction Individual Income Tax. Over 9000 but not over 25000. In some traditional definitions a tax haven also offers financial secrecy.

Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. As of 1 January 2018 the tax brackets have been updated due to the passage of the Tax Cuts and Jobs Act. Marginal tax rate.

Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. The two-year threshold was extended to five years in 2018 and ten years in 2021. We dont use your email calendar or other personal content to.

Growth of religion involves the spread of individual religions and the increase in the numbers of religious adherents around the world. Individual tax status means that the tax ID you entered is associated with an individual account type. Malaysia Sales Tax 2018.

Rate TaxRM A. BRICS software spending growth rate 2012-2014 WSP Globals revenue 2014-2021 Industry revenue of manufacture of steam generators in the United Kingdom 2012-2025. Political Hardening Index 1996-2011 base year 1996 100.

Studies in the 21st century suggest that in terms of percentage and worldwide spread. Helps students to turn their drafts into complete essays of Pro level. Massachusetts woman accused of weaponizing bees to stop officers trying to enforce eviction.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. At the subsequent meeting of the. Were transparent about data collection and use so you can make informed decisions.

Net taxable income USD Tax. New Zealand residents are liable for tax on their worldwide taxable income. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

The first specific step towards the establishment of the United Nations was the Inter-Allied conference that led to the Declaration of St Jamess Palace on 12 June 1941. Individual Life Cycle. For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000.

The fee is sometimes also required to own a radio or receive radio broadcasts. An individual arriving in Malaysia who is subject to tax in the following year of assessment. A television licence or broadcast receiving licence is a payment required in many countries for the reception of television broadcasts or the possession of a television set where some broadcasts are funded in full or in part by the licence fee paid.

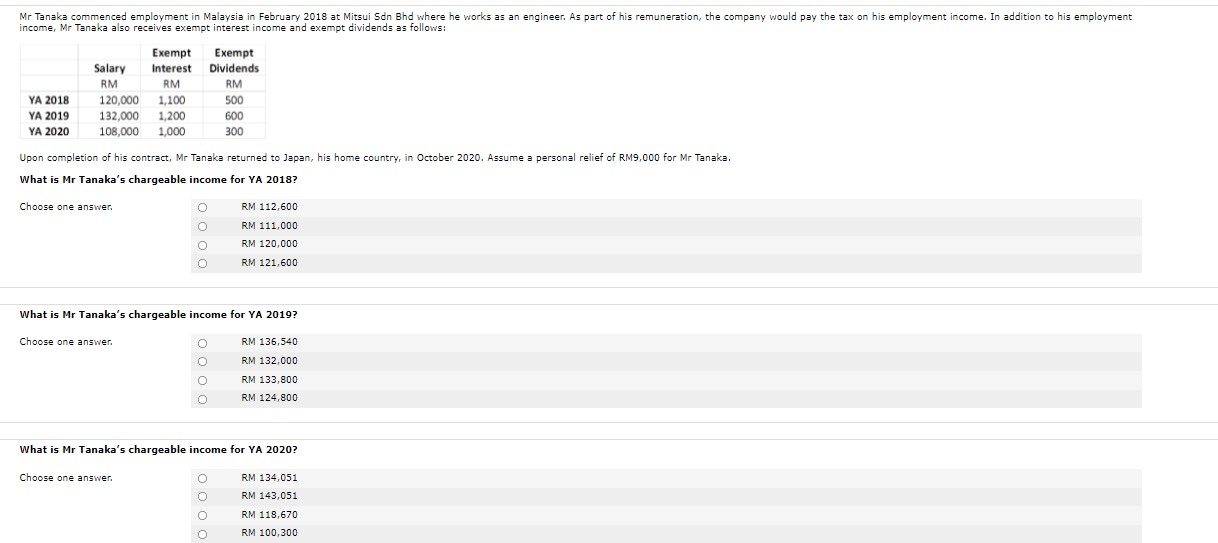

However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be. Malaysia Service Tax 2018. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

0 Taxable income band MYR. Most popular South Korean celebrities in Malaysia 2017. European patent applications from Malaysia 2009-2020.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. For the 2018 to 2020 years of assessment a 50 exemption applies to rental income received from residential homes if the following conditions are met. The following regular tax rates remain in effect for 2018 and future years.

Québec Sales Tax QST rate is 9975 and applies to all Google Ads customers in the province who have not added a QST registration number to their payments profiles. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Public protests civil violence and food price indices 2012 Figure 52. June 1 2018 until March 31 2019. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018.

Inflation rate in Turkmenistan 2027. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Payee refers to a non-resident individualbody other than individual in Malaysia who receives the above payments.

On the First 5000. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. Taxable income band MYR.

Individual income tax rates residents Financial years 201819 201920 Taxable income. Statistics commonly measure the absolute number of adherents the percentage of the absolute growth per-year and the growth of converts in the world. Fine-crafting custom academic essays for each individuals success - on time.

Giving you the feedback you need to break new grounds with your writing. Outlook puts you in control of your privacy. Effective tax rate MYR 0 5000 Nil 0 MYR 5001 20000 1 for each MYR 1 over MYR 5000.

Malaysia Personal Income Tax Rate.

Corporate Tax Rates Around The World Tax Foundation

Taxation In New Zealand Wikipedia

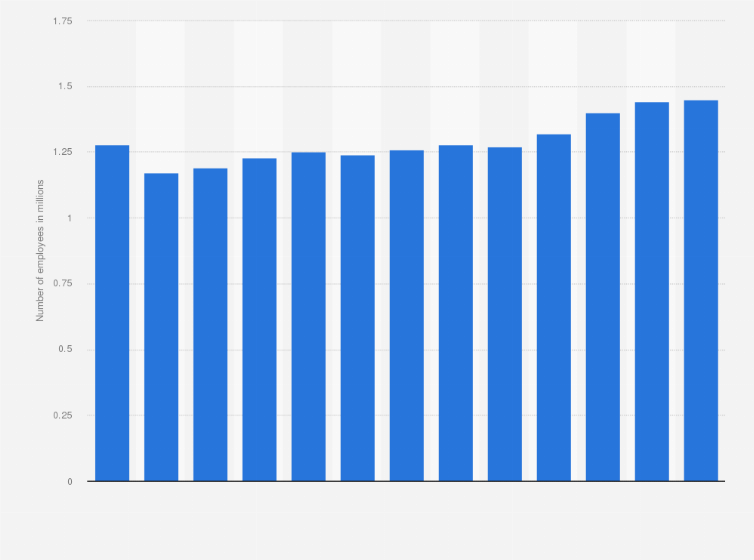

Accounting Employees U S 2021 Statista

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Withholding Tax On Foreign Service Providers In Malaysia

Why It Matters In Paying Taxes Doing Business World Bank Group

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Corporate Tax Rates Around The World Tax Foundation

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Malaysia Tax Rate For Company And Income Tax For Foreigners And Local

Effective Tax Rate Formula Calculator Excel Template

Tax Rates And Allowances The Following Tax Rates Chegg Com

Comparing Tax Rates Across Asean Asean Business News

Corporate Tax Rates Around The World Tax Foundation

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rates 2022

0 Response to "individual tax rate 2018 malaysia"

Post a Comment